Medicare

We have the experience and expertise to help

Helping people in the community is exactly what we do. We have helped thousands of people just like you not only make sense of the confusing subject of “Medicare" and "insurance”, but figure out ways to save money in the process.

Please take the opportunity to get to know us. Let our years of experience help you today. Please do not hesitate to call us with questions you may have.

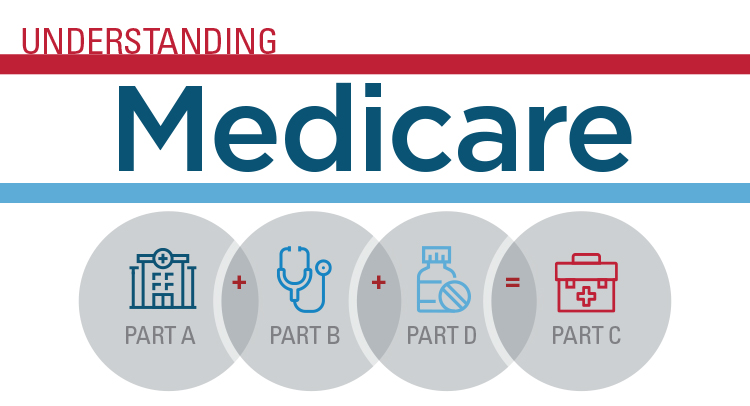

Medicare 101

As a federal health insurance program, Medicare stands out among the examples of successful social programs if for no other reason than the fact that it has survived for the past five decades with few significant modifications. To understand how Medicare affects your life as an American citizen, you need to appreciate that the program was an unprecedented measure in its day. Today, it continues to fulfill a vital need for senior citizens and those with certain disabilities or illnesses.

Original Medicare is coverage managed by the federal government. Generally, there's a cost for each service. Here are the general rules for how it works:

Factors that affect Original Medicare out-of-pocket costs

- Whether you have Part A and/or Part B. Most people have both.

- Whether your doctor, other healthcare provider, or supplier accepts assignment.

- The type of healthcare you need and how often you need it.

- Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

- Whether you have other health insurance that works with Medicare.

- Whether you have Medicaid or get state help paying your Medicare costs.

- Whether you have a Medicare Supplement Insurance (Medigap) policy.

- Whether you and your doctor or other healthcare provider sign a private contract.

Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, also known as Medigap, pays for some of the expenses not covered by the original Medicare program (Parts A and B). Medicare supplements are not designed to replace Medicare. Instead, they supplement Original Medicare by paying for things such as co-payments, coinsurance, deductibles and more. Medigap or Medicare Supplemental Insurance plans are standardized by the same agency that oversees Medicare, but these plans are sold and administered by private companies.

Medicare Advantage Plans

Medicare Advantage plans, also called Medicare Part C are health insurance plans that are approved by Medicare and run by private insurance companies. A Medicare Advantage plan is required to provide all Medicare Part A and Medicare Part B benefits and may include prescription drug coverage. Most Medicare Advantage Plans also add additional benefits like dental or vision coverage, health club memberships, medical transportation, or coverage for hearing aids. Although some require the beneficiary to pay a premium they are considerably lower than most Medicare supplements.

Medicare Pard D Prescription Drug Plan

Part D adds prescription drug coverage to Original Medicare and some Medicare Advantage plans. These plans are offered by private companies approved by Medicare, and must follow guidelines established by The Centers for Medicare and Medicaid Services.

When to enroll in Medicare Part D

If you are enrolled in Medicare Part A and/or Part B and live in your plan’s service area, you can enroll in the Medicare drug benefit (Part D) during your Initial Enrollment Period (IEP).

Your IEP for Part D will usually be the same as for Part B: the seven-month period that includes the three months before the month you become eligible for Medicare, the month you are eligible, and three months after the month you become eligible. For example, if you become eligible for Medicare when you turn 65 on May 15, your IEP will be February 1 to August 31.

Note: If you are disabled and are turning 65 you will qualify for a new Part D IEP. That IEP will last seven months including the three months before you turn 65, the month you turn 65, and the three months after you turn 65. If you were paying a Medicare drug benefit premium penalty because you signed up late for Part D before you turned 65, you will no longer have to pay this once your Part D IEP begins.

If you join a Medicare drug plan during the three months before you are eligible for Medicare, your coverage will start the month you become eligible. If you join a Medicare drug plan during the month you become eligible, or during the three months afterward, your drug coverage will start the first of the month after you enroll. You should enroll early during your IEP to make sure that your coverage begins as soon as you are eligible.

If you do not join a Medicare drug plan during your Initial Enrollment Period, you may not be able to enroll until Fall Open Enrollment. Open Enrollment begins October 15 and ends December 7. Changes and enrollments made during Open Enrollment become effective January 1. You may also have to pay a premium penalty.

You may also have a Special Enrollment Period to enroll in Part D under exceptional circumstances, including if:

- you get Extra Help

- you lose employer drug coverage